Which Best Describes an Example of Using Unsecured Credit

Which describes an example of using unsecured credit. 70 There are no advantages to the use of credit cards and they should be avoided at all cost.

Understanding Different Types Of Credit Nextadvisor With Time

71 A student loan is another type of unsecured credit.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

. Student loans personal loans and credit. A credit score between 500 and 600 means a consumer would most likely. What best determines whether a borrowers interest rate goes up or down.

Unsecured credit happens when there is no assurance to guarantee the credit which will increase the risk of potential loss in the process. Unsecured credit refers to loans not guaranteed by collateral such as a cash reserve real estate property or other assets of value. What is the compound interest on a three-year 10000 loan at a 10 percent annual interest rate.

Which describes an example of using unsecured credit. Someone buys new gutters for a home with a credit card. One example is a credit card.

A someone buys new gutters for a home with a credit cardb someone buys a new vehicle with a loan from a car dealerc someone buys a new home with a mortgage from the bankd someone buys a new boat with a loan from a boat dealer. Which best describes a way people can use personal loans. Which describes the difference between secured and unsecured credit.

69 Your use of credit cards can pay off in the form of free plane tickets free hotel stays or cash back and discounts. Which describes an example of using unsecured credit. An example of using unsecured credit is.

Someone buying new gutters for a home with a credit card. Unsecured credit can be used as an example of using unsecured credit by purchasing new gutters with a credit card or taking out loans from banks without putting anything up in return. Which describes an example of using unsecured credit.

An unsecured loan requires no collateral though you are still charged interest and sometimes fees. Someone buys new gutters for a home with a credit card. Someone buys new gutters for a home with a credit card.

Which describes an example of using unsecured credit. Unsecured credit always comes with higher interest rates because it is riskier for lenders. The following items are unsecured credit.

An unsecured loan requires no collateral though you are still charged interest and sometimes fees. Please select the word from the list that best fits the. Which describes an example of using unsecured credit.

Get the answers you need now. Which describes an example of using unsecured credit. Examples of unsecured credit include traditional credit cards personal loans and lines of credit.

Which describes an example of using unsecured credit. Unsecured credit happens when there is 7. An example of using unsecured credit is.

An example of secured credit is a. Taking out loans from banks without putting anything up in return. Someone buys new gutters for a home with a credit card.

A person with a credit score of 760 with a small amount of debt who has had steady employment for many years. A few common examples of unsecured credit include. Someone buys a new vehicle with a loan from a car dealer.

1 See answer Advertisement Advertisement yeomans8172 is waiting for your help. Someone buys new gutters for a home with a credit card. Someone buys new gutters for a home with a credit card.

A secured line of credit is guaranteed by collateral such as a home. Its called this because its a type of financing thats typically issued based on the strength of your credit profile and your promise to repay. An unsecured line of credit is not guaranteed by any asset.

To pay for college. An example of using unsecured credit is. Yeomans8172 yeomans8172 1 week ago SAT High School answered Which describes an example of using unsecured credit.

Someone buys a new home with a mortgage from a bank. Which describes an example of using unsecured credit. Examples of secured credit are mortgages secured by the property prepaid credit cards secured by cash reserves and.

The lenders security is limited to expectations based on your credit history. Unsecured credit happens when there is 7. Someone buys new gutters for a home with a credit card.

Pdf The Role Of Credit Cards In Providing Financing For Small Businesses

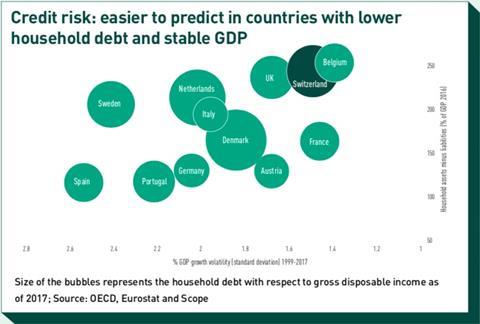

Switzerland Online Lending Features Ipe

How To Obtain An Unsecured Credit Card Howwow

Pdf Interest Rates And Default In Unsecured Loan Markets

Mortgage Buyout Agreement Luxury 11 Mortgage Agreement Templates Mortgage Agreement Mortgage Agreement

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Expense Budget Templates 15 Free Ms Xlsx Pdf Docs Budget Template Budgeting Templates

/Paycreditcarddebt-d3d67e258ffa4587965ef12f24f19c13.jpg)

Secured Vs Unsecured Lines Of Credit

We Re Hiring Check Out Our Career Portal For Current Openings For Work Love My Job Quotes Job Quotes Work Quotes

Pdf The Role Of Secured Credit In Small Business Lending

Pdf The Role Of Credit Cards In Providing Financing For Small Businesses

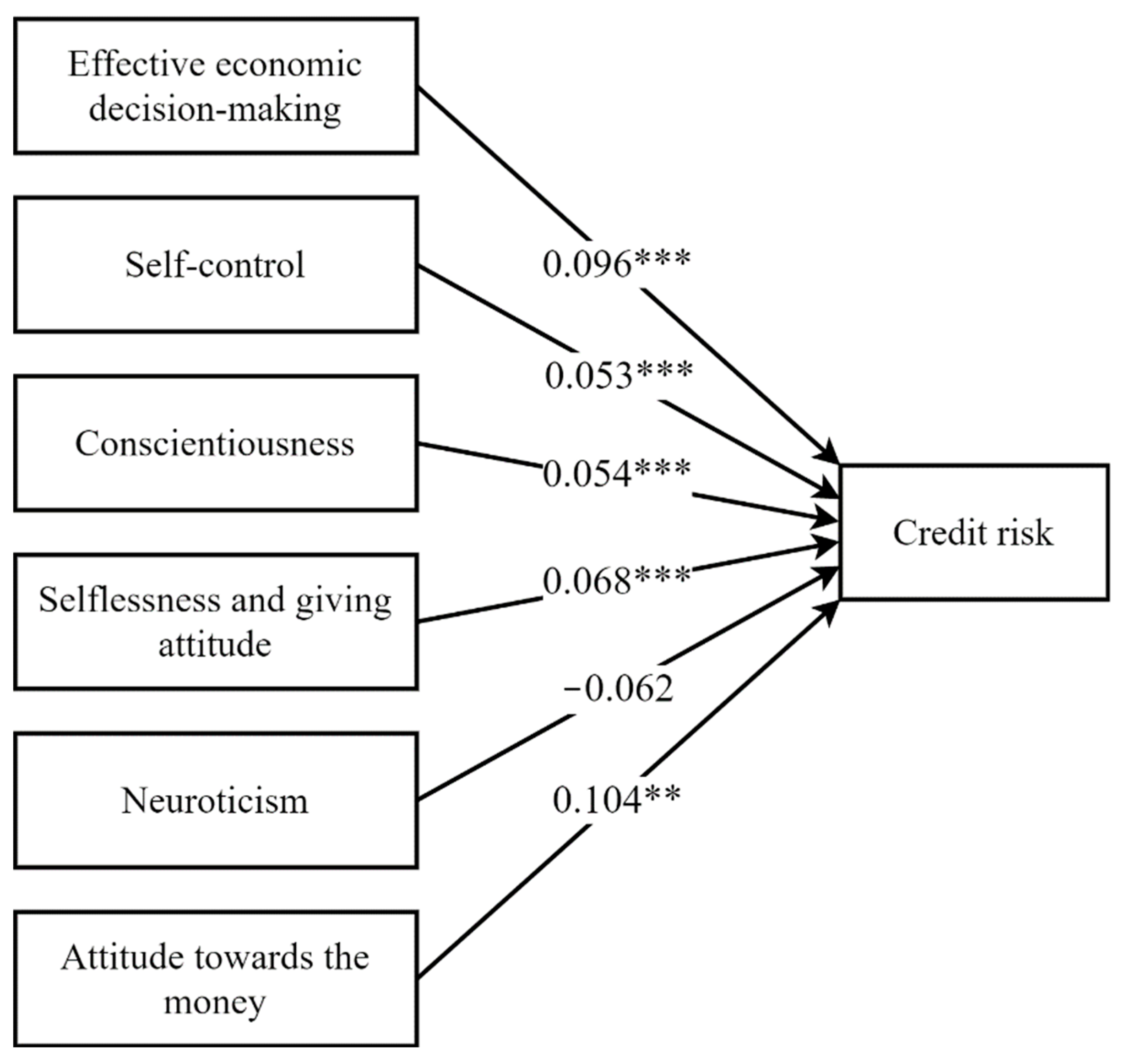

Behavioral Sciences Free Full Text Effect Of Psychological Factors On Credit Risk A Case Study Of The Microlending Service In Mongolia Html

Pdf Predicting Prepayment And Default Risks Of Unsecured Consumer Loans In Online Lending

Pdf Indicating Financial Distress Using Probability Forecasts An Application To The Uk Unsecured Credit Market

Distressed Debt Clever Ways To Do The Dumbest Things Euromoney

5 Things To Know About The Unity Visa Secured Credit Card Nerdwallet

Comments

Post a Comment